Past-producing high-grade Nickel-Copper-Cobalt-PGE Project located in the Tier-1 Timmins Camp

Highlights

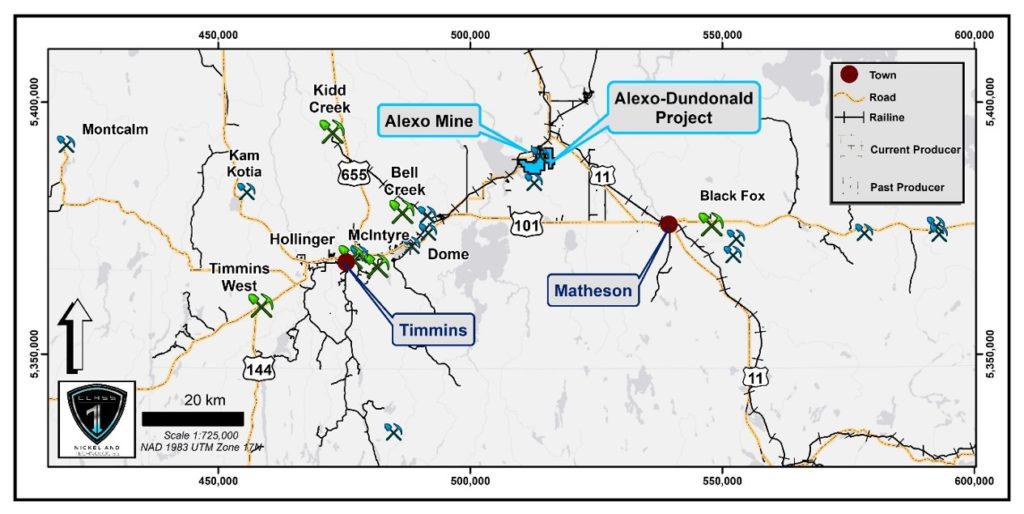

- Situated 45 km northeast of Timmins with year-round road access, proximal to operating process plants

- Glencore’s Strathcona process plant near Sudbury;

- Kidd Metallurgical Site ~30 km away

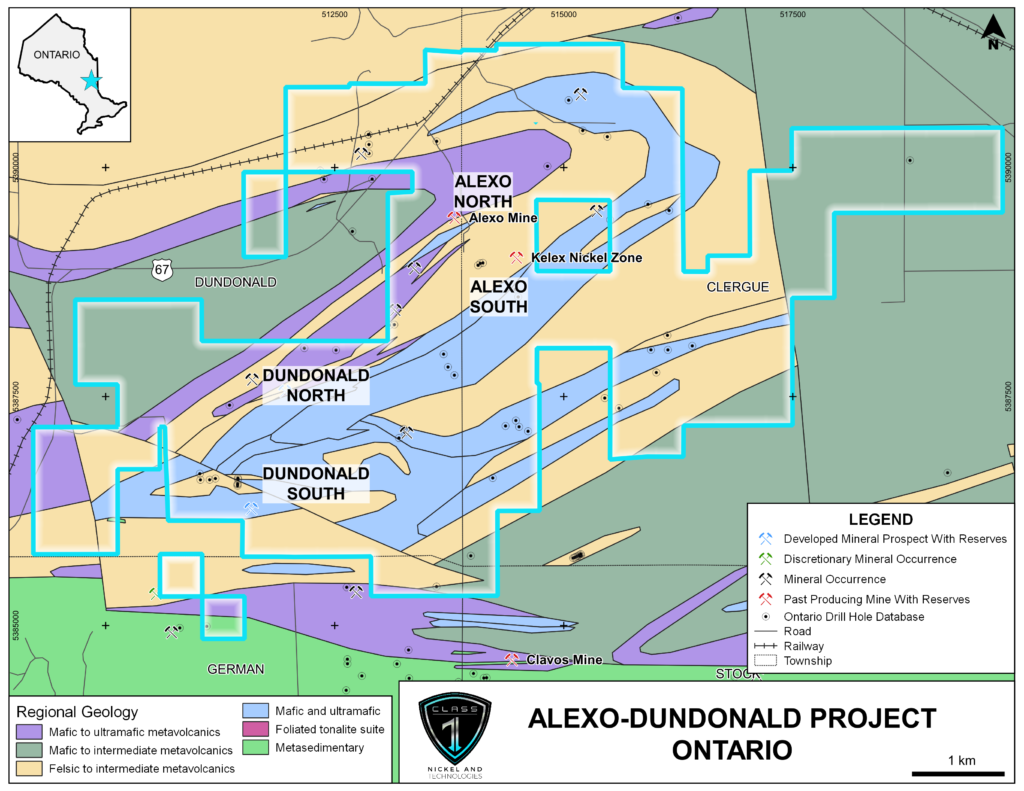

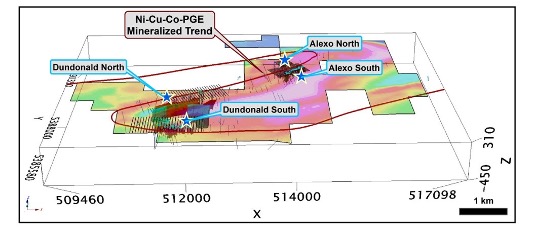

- The Alexo-Dundonald Project comprises four deposits comprising 92 granted exploration licences, with a combined area of 19 km2 and over a ~14 km strike-length of folded komatiite units

- Alexo North ( past-producing)

- Alexo South, (Kelex) Mines ( operational during 2004 to 2005).

- Dundonald North and

- Dundonald South

-

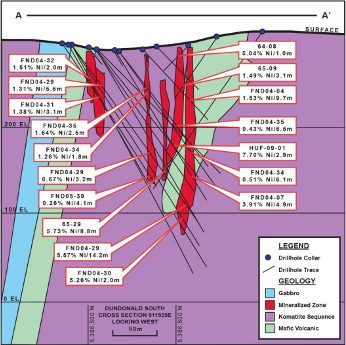

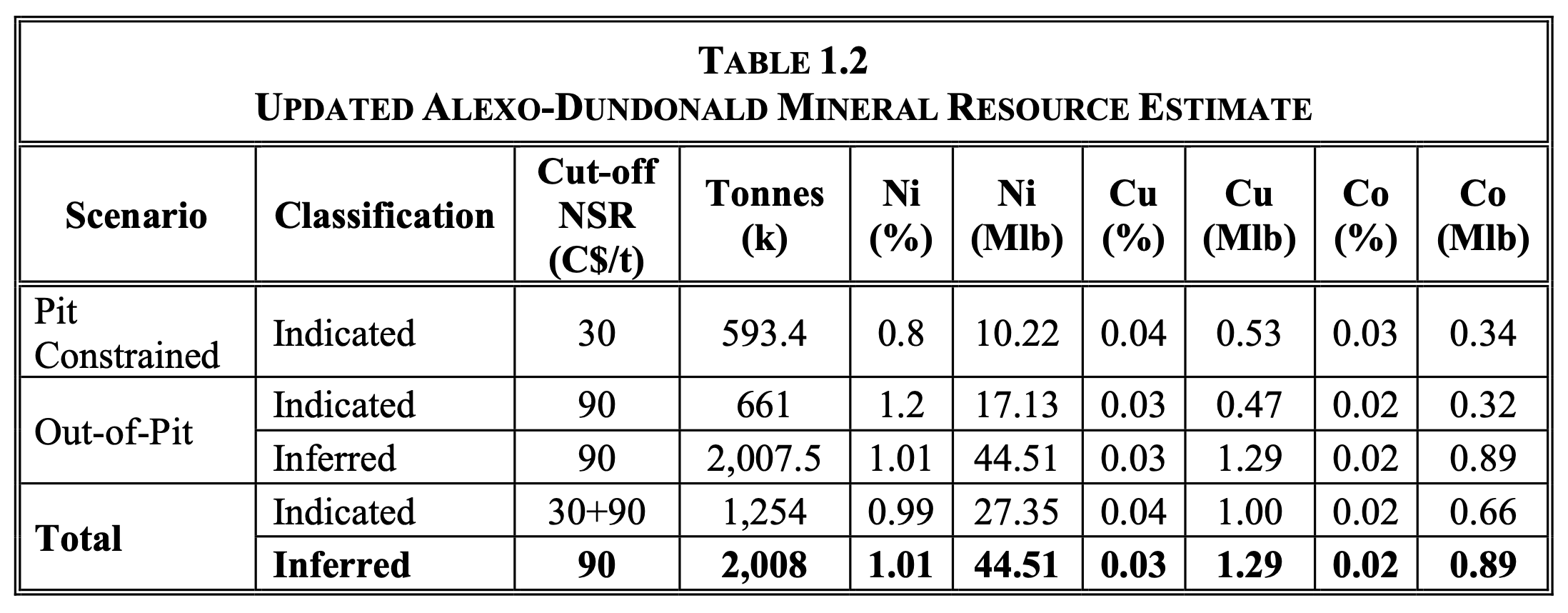

Historically, Alexo was a shallow, high-grade nickel sulphide mine, allowing Class 1 Nickel to leverage significant historic exploration and expenditure to delineate a MRE Indicated of 1,254 Kt with average grade 0.99% and a total MRE inferred of 2,007 Kt with average grade 1.01% (3.25Mt @ 1% total), and JORC 2012 equivalent Indicated and Inferred Mineral Resource Estimate at Alexo-Dundonald of 4.19Mt @ 0.92% Ni for 39Kt of nickel metal

-

Given the Project’s historic production profile, and the existing shallow Resource, Class 1 is well-positioned for a potentially low capex, high-margin production restart

Alexo-Dundonald Mineral Resources

2020 NI 43-101 Mineral Resource containing nickel, copper, and cobalt, with favourable nickel grades.

- Alexo-Dundonald has a total Indicated Mineral Resource of 1,254 kt with an average grade of 0.99% Ni and a total Inferred Mineral Resource of 2,007 kt with an average nickel grade of 1.01% Ni

Strong Short-Medium Term Production Potential

- Alexo-Dundonald was previously operated as a direct shipping operation, with last mining completed in 2004/05 for 30.1Kt ore @ 1.92% at an attractive operating cost of just C$1.06 per pound of Ni metal*

-

With a shallow, high-grade Resource, excellent access to existing brownfields infrastructure and local processing facilities, Class 1 Nickel is well-positioned for a mining restart

-

Through utilizing third-party facilities for toll milling, management expect that production of a pre-concentrate can be ramped up quickly with little minimal pre-production capex. Based on assumptions from the previous operations operating costs will be largely limited to mining and haulage*

-

Mineralized material from Alexo was historically processed at Glencore’s Strathcona mill with high metallurgical recoveries. Last year Strathcona Mill had approx. 2,500tpd in excess capacity, which management estimate is more than enough capacity to potentially underpin a highly profitable operation**

-

While Class 1 Nickel is yet to publish a PEA, management have had offtake conversations with top-tier automakers, highlighting the demand for a production restart at Alexo-Dundonald, and the availability of the Nickel Resource

* SEDAR filings of Canadian Arrow Minerals Limited in 2004 and 2005. Operating costs are historical in nature and have not been verified by a Qualified Person.

**Glencore’s 2021 Sudbury INO Production Numbers.